Diverse, discerning, and culturally engaged

When the Immersive Experience Network (IEN) was founded in early 2022, we recognized a significant gap: the lack of research and accessible data to support commercial decisions, develop marketing strategies, and aid funding applications. Whilst the cultural participation monitor collected data for the broader Creative and Cultural Industries (CCI) sector, there was a scarcity of specific, freely accessible insights into the immersive industry and its audiences.

Over the past eight months, we have been working on putting together a unique study about audiences who engage with immersive work. This research explores what they enjoy, what influences their choices, what they value about immersive and the platforms they use to discover new experiences.

We are now making this comprehensive report available to benefit and support the growth of the emerging immersive sector. Funded by Medea and our industry partners, this report represents another step towards building a collaborative community of creators dedicated to advancing immersive work in the UK and beyond.

Who are our audiences?

We partnered with market research experts Savanta to survey 2,000 people who had been to an immersive experience over the last 12 months. Following our research into the immersive genres our research included audiences of Immersive & Interactive Theatre, Escape Rooms, Immersive & Experiential Art, Location based AR & VR, Immersive Audio, Scare Attractions, Live Action Role Play, Experiential & Immersive Art, Transmedia Experiences & Args, and Themed Attractions.

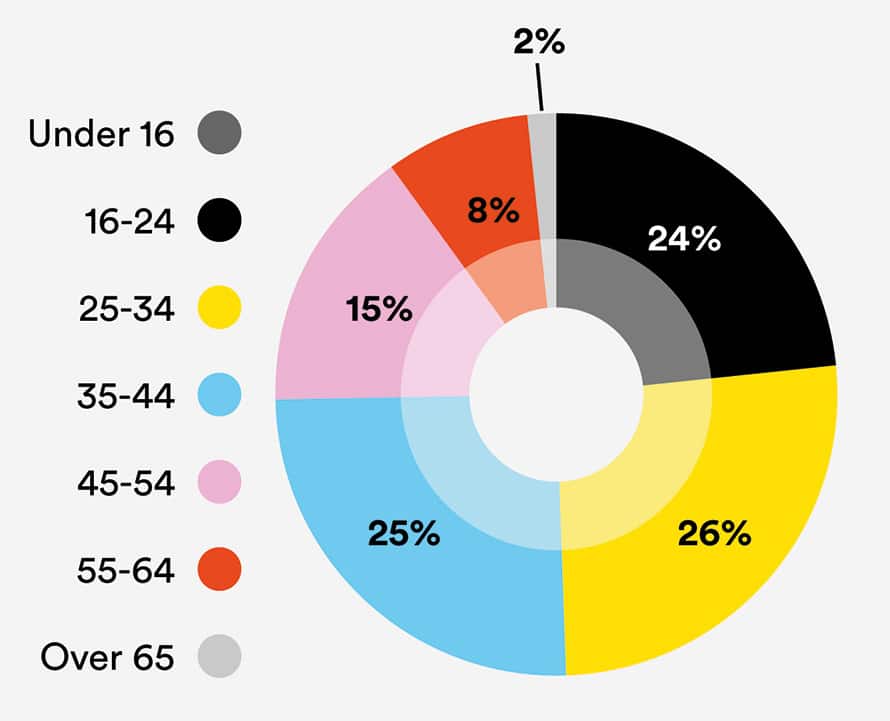

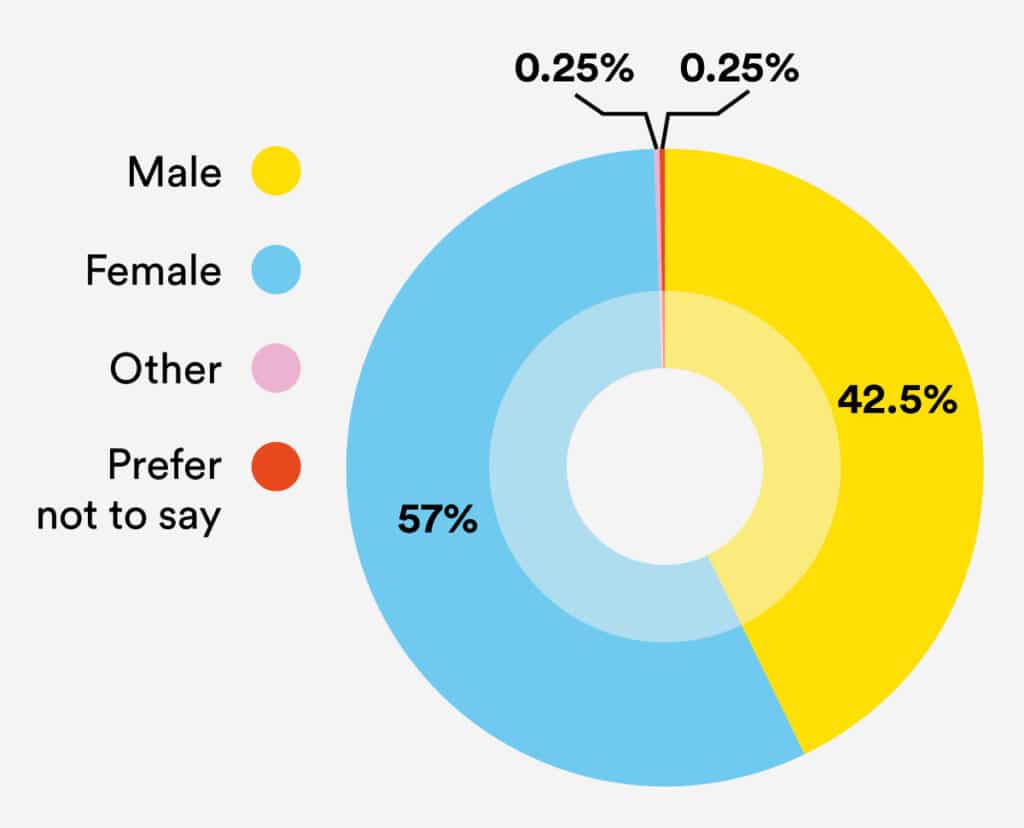

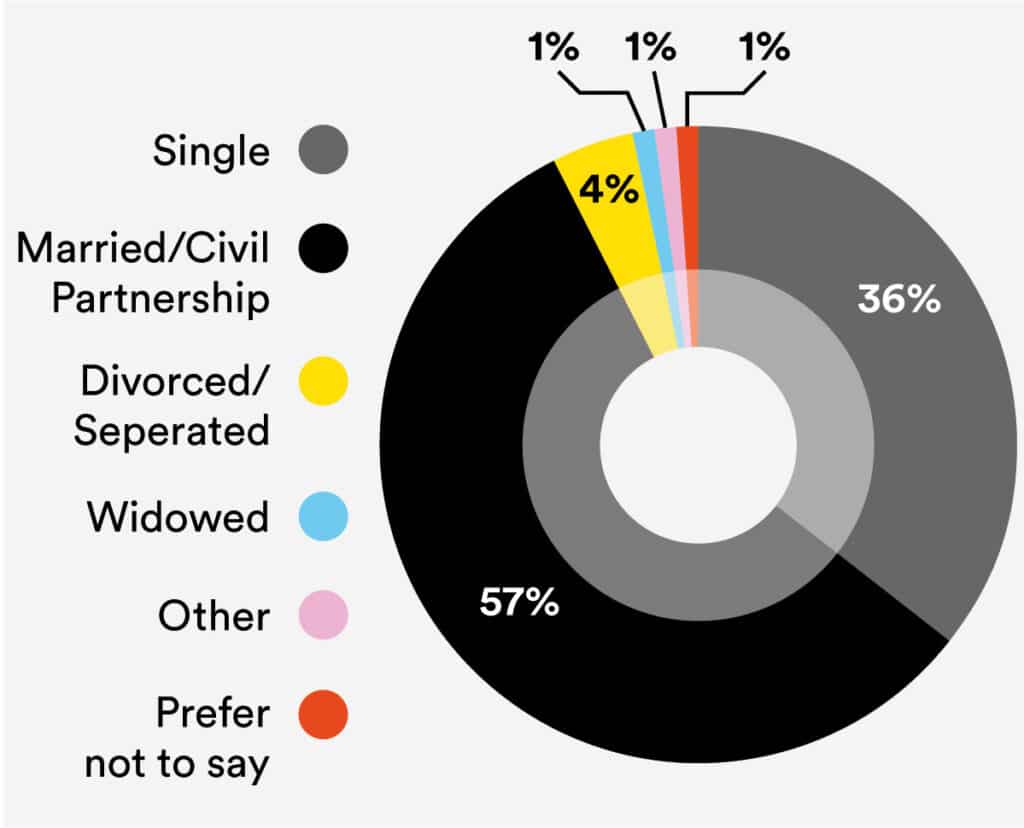

Our audience demographic revealed an insight into who is going to immersive experiences in the UK.

Age Group

Gender

Family Status

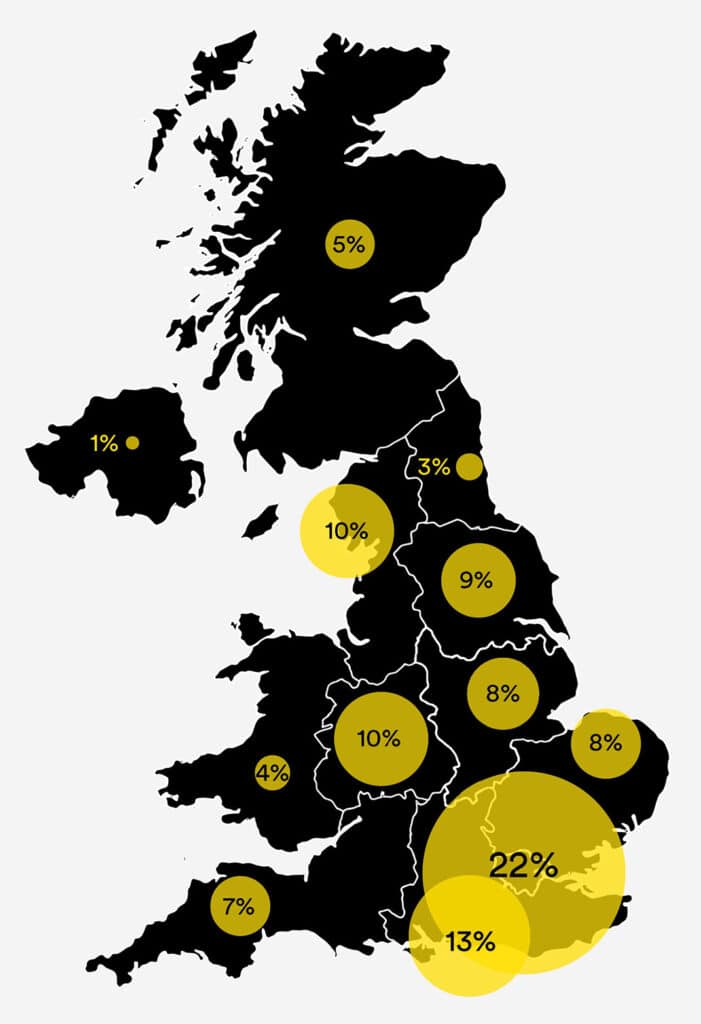

Location

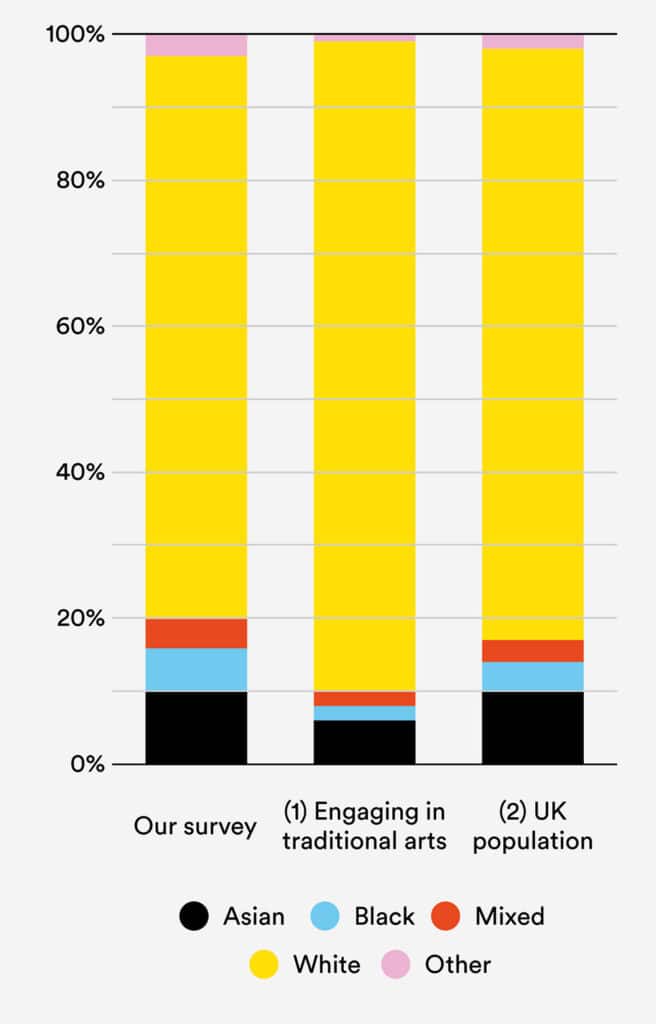

Ethnic Diversity

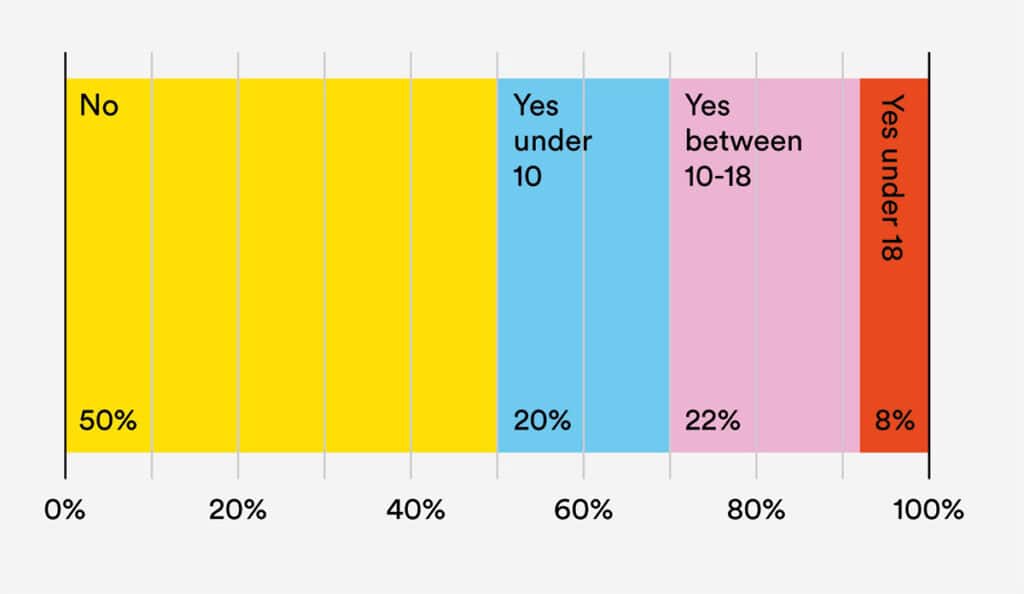

Children in household

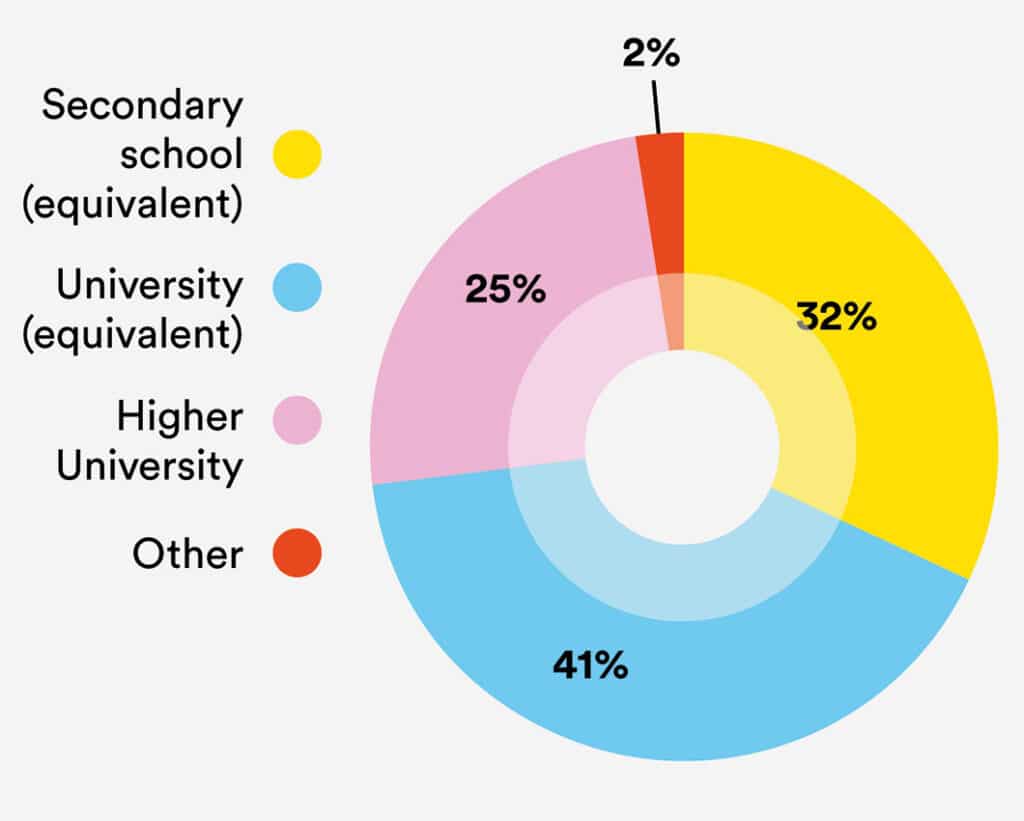

Education Level

Our data shows a wide range of people are currently engaging with immersive experiences across the UK, a sign of the strong growth in the sector and potential for a lot more.

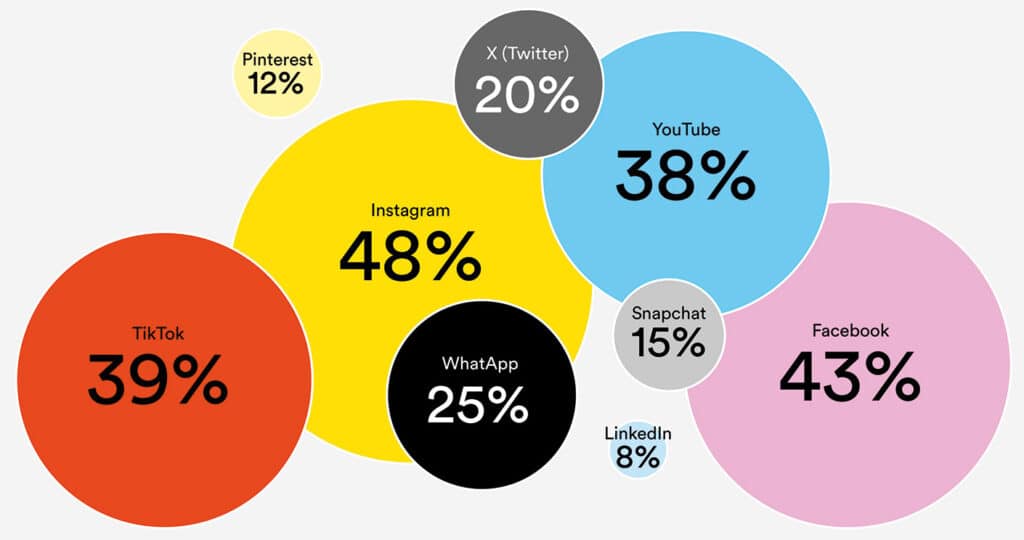

We also asked them what platforms they used to discover experiences they might want to go to. Overwhelmingly there was a strong trend towards socials based video platforms further underlining the importance of video as a way of marketing immersive work to new audiences.

What social media platforms do you use to find out about experiences you go to?

What do immersive audiences want?

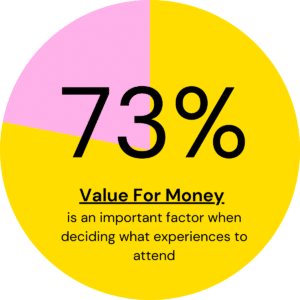

We profiled the audience in our survey and looked into what other leisure activities they were interested in, alongside what they looked for when choosing what experiences to engage with. Our data shows that value for money was the highest priorities amongst our survey respondents, maybe unsurprisingly in the current financial climate.

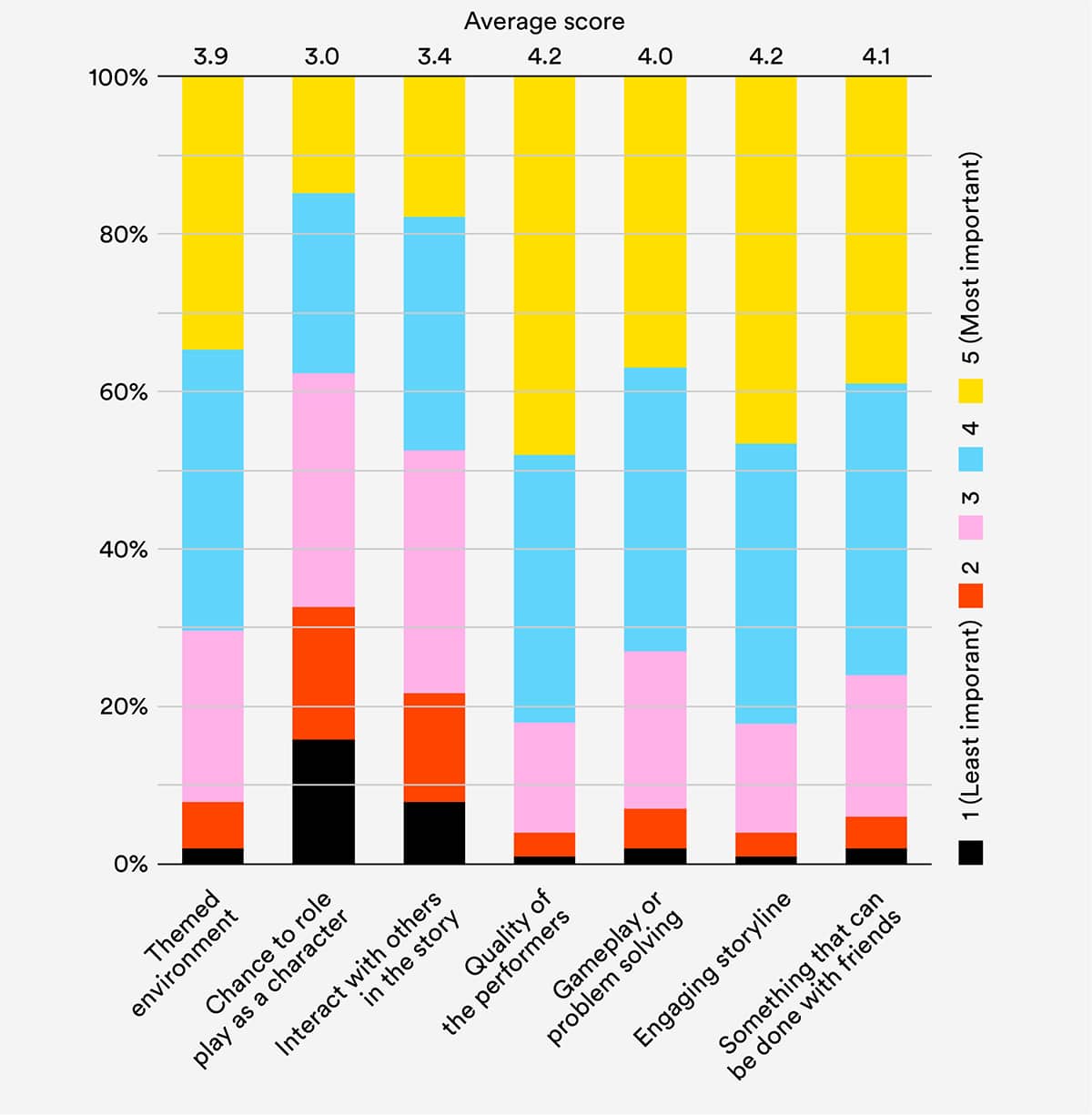

What are the most important aspects of immersive experiences? (1 – 5 scale)

Our research on what audiences value most in an immersive experiences revealed that the quality of performers was the highest scored response. This finding should serve as a call to action for the immersive experience sector to emphasise the nurturing and development of immersive performance skills.

This effort should start at the grassroots level, where experienced producers, directors, and performers collaborate with the education sector to create specialised training for aspiring immersive performers.

Arguably this should also extend to the professional level, where we need to reexamine casting practices, rehearsal processes, pay rates, working conditions, and support systems to ensure a sustainable and thriving immersive performance industry.

But what is immersive?

In our first report In Your Own Words in April 2023, we began to get some insight into the ways that creators describe their work, both within the sector and externally, to audiences, press, and partners. “There’s kind of a marketing arms race in immersive,” said one immersive producer in a focus group for the report, “everything wants to list itself as immersive.” A sense that the word has lost its impact in a crowded marketplace is juxtaposed with the fact that it is still by some distance the most ubiquitous word in marketing and dialogue between creators and audience.

In last year’s research, when we asked creators asked to use 5 words to describe their work, the most popular words were still “immersive”, “interactive” and “experiential”, by some distance.

This Immersive Audience Report builds a complementary perspective to the In Your Own Words creators report; this time looking inwards from audience participants. We asked our audience sample, ‘What do you think when something is described as Immersive?’ to understand where their view aligns with and diverges from what the makers of these experiences might be aiming for.

Our report directly compares and contrasts the responses from creators and audiences to identify what audiences perceive when something is described as immersive, and how that aligns with the creators making the work.

Immersive Ticket Pricing

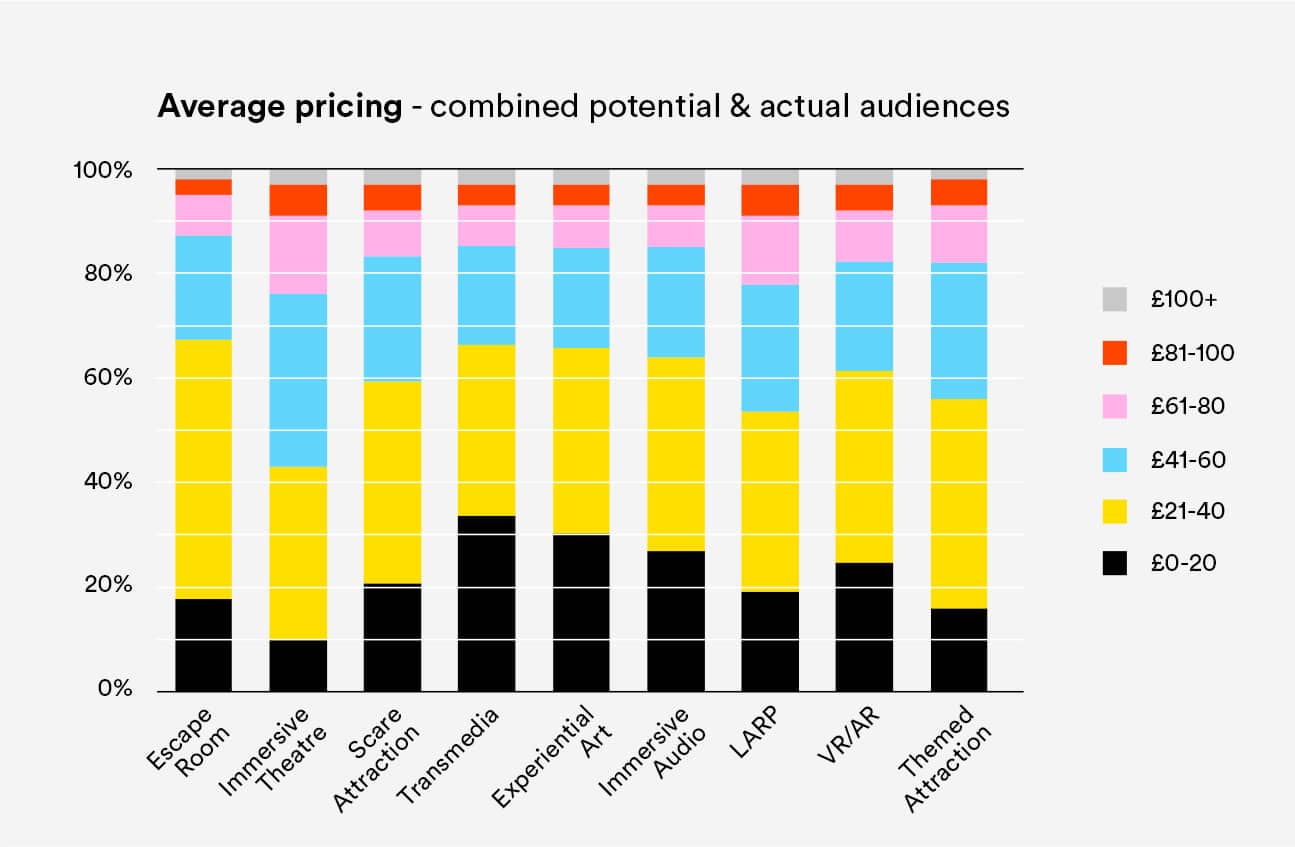

Our report for the first time does an in-depth dive into the immersive genres to see what types of immersive work audiences are engaging with, what other genres they’d be potentially interested in engaging with and what they’d consider to be a fair price for the experience.

Our data shows the different average price expectations for the different types of immersive experiences, with interesting insights into what maximum price they’d pay if they thought it’d be particularly special.

Average pricing for different genres of immersive experience

But is it culture and should we be able to apply for theatre tax relief?

Many immersive creators have struggled to access support for their work because it doesn’t fit into the traditional cultural boxes. This report is also the start of our campaign for better recognition of the cultural importance of some of the work being made in the sector, and thus making the case that it should be supported where appropriate with arts funding and tax relief schemes to help fuel the growth of immersive work.

Later this year we’ll be launching a membership program where you can join us in this campaign to work collectively to raise the visibility of the immersive work and lobby for recognition of this incredibly vibrant emerging sector.

Get the Report

If you have any problems downloading the report, please contact us.